30+ Minimum payment on credit card

But it can make senseoccasionally. A credit card issued on or after August 1 2019 your minimum payment will be at least 5 of your statement balance.

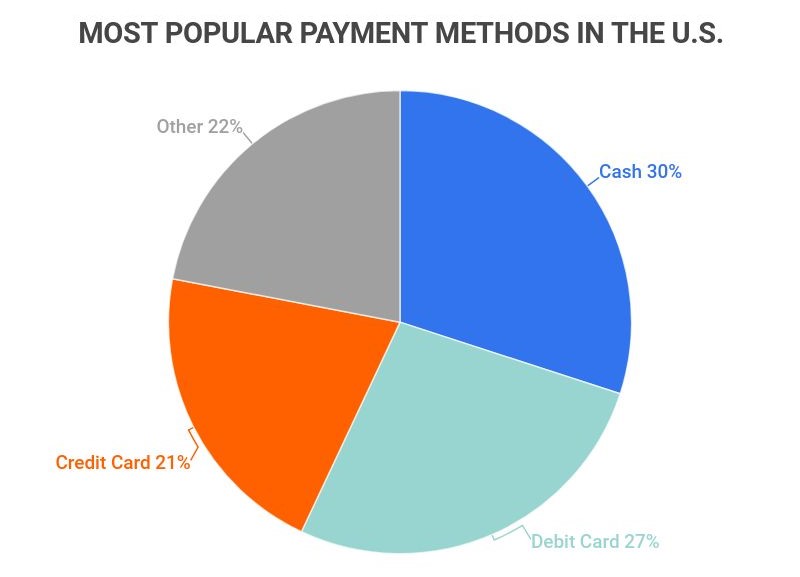

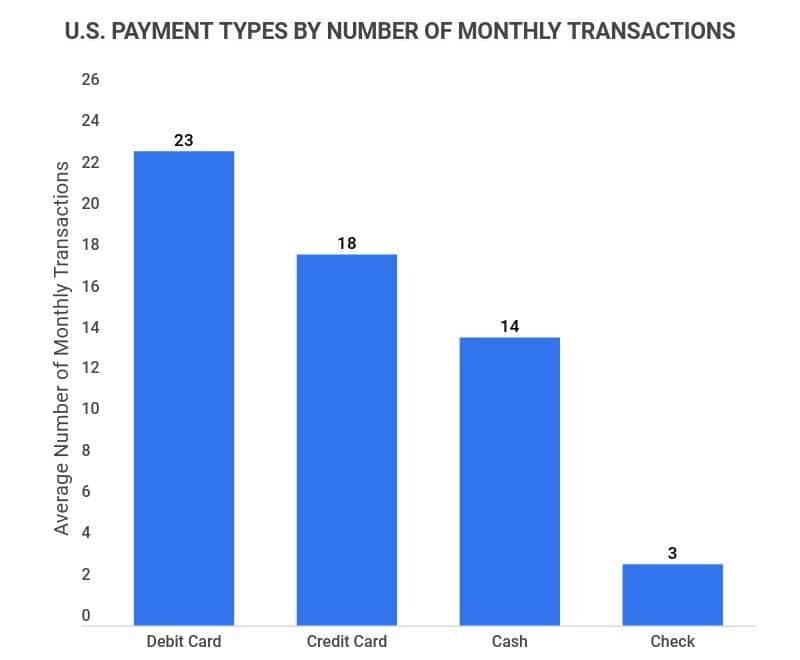

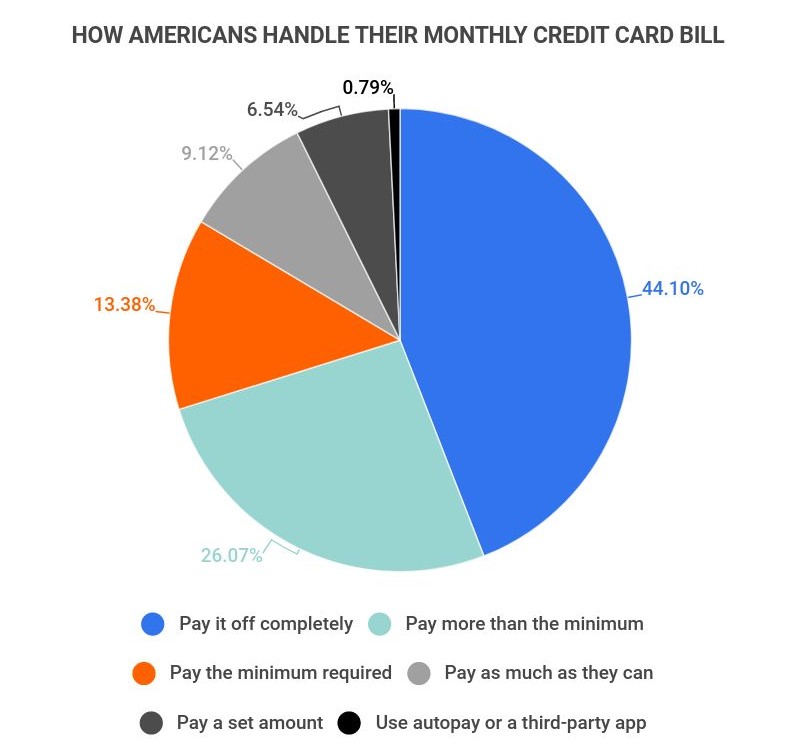

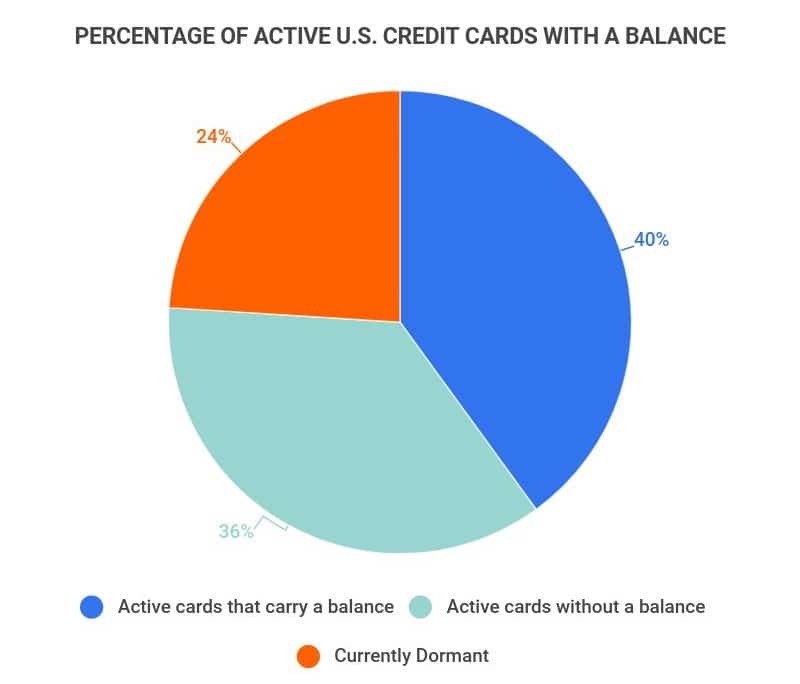

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

A cardholders minimum payment is based on the current balance and interest rate.

. Credit card bills show the total amount you owe and the minimum payment due. 6 days ago. On-time payments are crucial for maintaining a healthy credit profile your payment history constitutes 35 of your overall credit score.

Creditors determine your minimum payment by using one of three different methods which include. If you only make your minimum payments it will be almost 35 years before youve fully paid off your card. However keep in mind that if you only pay the.

Lets say you have a credit card with a 20 APR a 6000 statement balance and a 180 minimum payment. Ad Our Nerds Have Done The Work For You. Your minimum required payment is typically anywhere from 2 to 4 of your total balance for that billing cycle depending on your particular card agreement.

Ad Find your next credit card with. When it comes to your financial health minimum payments on your credit cards are poison. Credit card minimum payments are usually calculated based on your monthly balance.

The minimum payment on a 3000 credit card balance is at least 30 plus any fees interest and past-due amounts if applicable. Citi Custom Cash SUB now requires 1500 spend. With NerdWallet compare top credit cards filtered by credit score reward type and more.

After your minimum payment is more than 30 days late the credit card issuer will report the late payment to the credit bureaus. Old offer still available elsewhere. Its the 1 way to avoid penalties fees and a revolving balance.

Easily Browse Our Best Credit Cards. A flat percentage of your total outstanding balance. Cards issued before August 1 2019 will eventually adapt.

A 2000 credit balance with an 18 annual rate with a minimum payment of 2 of the balance. Credit Card Minimum Payments Calculator. If you paid only the minimum it would take you around 50 months to.

If you were late making a payment for the previous billing. For transactions of 250 or more the credit card. It is either a percentage of the total or a fixed amount depending on your balance threshold.

This calculator will show just how much total interest you will pay if you only make the minimum payment required on your credit card balance. Youll generally owe either a fixed amount often 25 or a percentage of the balance whichevers. Making only a credit cards minimum payment can greatly extend the time it takes to pay a balance and drive up interest costs.

Credit card issuers tend to set minimum payment requirements at rock-bottom levels. Should you fail to pay the minimum. The minimum payment is usually a percentage so how much youll pay will depend on a couple of things the amount you owe and your credit card providers rules.

The Big Lots credit card is a great way for customers to save money when shopping online or in-store at Big Lots. All Credit Types Accepted. A credit card minimum payment is simply the minimum amount of money you must pay each month to remain current on your debt.

Banks offer you two choices either pay the full amount or pay only the required minimum amount before the. While making payments on time is great paying them in full is ideal. Credit Karma offering 50 for applying for a card if you are denied.

The minimum payment could be a percentage of your balance plus new interest and. Pay More Than the Minimum. The minimum payment on your credit card statement is the smallest dollar amount you must pay in a given month.

Apply for a Top Rated Credit Card in Minutes. Youll pay more than 5000 in interest overallExample 1. A lender calculates the minimum payment based on the total credit card balance.

Apply - for All Credit Types. This late payment will go on your credit report. Ad Best Unsecured Credit Cards.

The minimum payment on a credit card is the lowest amount you must pay to avoid paying late charges and damaging your credit score. The minimum can change from month to month based on how the balance changes plus. Making the minimum payment doesnt do.

Compare rates by card type.

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

Get Free 20 Turn Your 40 Into 60 In Seconds Prepaid Debit Cards Visa Debit Card Budget Saving

Risk Management And Risk Reward Ratio Rules Risk Reward Risk Management Technical Analysis Charts

How To Get Out Of Debt Fast The Science Backed Way Student Loans Refinance Student Loans Student

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

How We Eat Out While On A Tight Budget Best Money Saving Tips Money Saving Meals Saving Money

How To Get A Credit Card With No Credit 2022

Volume Trading Strategy Win 77 Of Trades Trading Strategies Options Trading Strategies Trade Finance

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy Budget Planner Printable Money Planner Budget Planner

Home Finance Printables The Harmonized House Project Free Printable Labels Templates Label Design Finance Printables Credit Card Debt Worksheet Budgeting

Pin On Fintech

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

Minimum Viable Product What Is A Mvp And Why Is It Important Roadmap Technology Roadmap What Is A Product

Business Loan Business Loans Membership Card Loan

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

Average Credit Card Interest Rates Apr Stats 2022

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia